Growth marketing is a universal approach to digital marketing and promotion. While effective, though, you want to tailor your growth marketing strategy to the specific industry you’re operating in.

Case in point: Fintech.

If you’re a fintech company, you’re doing business in the competitive and ever-evolving financial technology sector, rife with competition and burdened by regulations. On top of that, fintech companies operate in YMYL (your money, your life) territory, which means accuracy and trust are critical. I’ve worked with quite a few clients that fall into this industry, and the first step is always to make sure trust is at the center of your strategy.

Acquiring customers in the fintech industry isn’t easy, which is why you need to have a solid plan in place to reach your marketing goals. Whether you’re a startup or an established fintech company, here are some top tips (backed up by experienced examples) that can help you establish a strong fintech marketing strategy.

Google may have rolled back its plans to kill third-party cookies in 2024, but that doesn’t change the fact that privacy is a priority for the internet. This de-emphasis on third-party data has made first-party data more available and important, including when you’re building a marketing campaign. First-party data provides valuable insights into the behavior and beliefs of your audience.

Before you begin allocating marketing efforts, look at your data. Where are your customers coming from? Where are they converting? What channels are yielding the results you’re looking for? Which ones need improving?

I saw the power of a first-party data review when working with a fintech client that had been marketing and tracking their data but wasn’t paying attention to it. I conducted a thorough review of the information to identify what areas were working and which ones had the highest opportunity so that we could prioritize them. This included a deep dive into GA4 and GSC to see what was getting traffic and what keywords were leading to sessions. It also included reviewing their internal data about their ideal client profile so we could align with it.

If you’re building a fintech marketing plan, always start with your data. Use the past to help you direct your future moves.

Every brand should have a clear unique selling proposition or USP. This factor helps you build brand awareness and makes your product or service stand out — and it’s just as important in the financial service sector as anywhere else.

The fintech landscape is fiercely competitive. There are many well-established fintech companies and countless startups all fighting for market share. If you want your marketing to stand out above the next brand’s ad or message, ask yourself these questions in this order:

Along with internally identifying your USP, you want to consider the external factors influencing the fintech business landscape. What kind of content marketing is ranking in the SERPs? Do you need to run paid ads to cut through the competition?

While working with the same fintech client mentioned above, we used competitor research to illuminate the best opportunities available to that brand. I studied larger companies, reviewed similar-sized enterprises, and even looked at a fintech startup or two. This gave me a broad sample of what marketing resonated with fintech audiences at the time, rather than only focusing on similar-sized brands. This research shows not only what is working and what isn’t for others, but also helps to find more niche areas of opportunity that others could be overlooking in their content marketing efforts.

If you want your fintech marketing strategies to succeed, start by identifying your strengths and studying the landscape you’re operating within.

Inbound marketing, especially content, is a core part of any marketing strategy. However, the kind of content you create has become an increasingly important part of the strategic planning process to drive brand awareness and customer engagement.

The internet is still reeling from the impact of major changes, like Google’s Helpful Content Update and the shift to AI-generated search responses. One of the big changes here is that you want your content to be more engaging, unique, and invaluable.

Simple answers are no longer going to cut it. Instead, think through the types of content that encourage fintech audiences to engage with your brand’s marketing assets and attract potential customers. This could be:

The relevance of the topics that you cover is just as important. For instance, when I was working with a fintech client, I emphasized the need for timely content. They were focused on alternative investments, and at the time, they barely had any content on their site about them. Because of that, I helped them develop 401(k)-focused content centered around alternative investments.

First we created some foundational content about what alternative investments are and why they can be beneficial, but then got deeper into specific types of alternative investments and specific strategies for incorporating them into your retirement plan. This helped them rank for a competitive, up-and-coming search term by demonstrating their authority without fighting against stiff competition or paying for expensive ads.

If you want your content to stand out and build customer loyalty, make it unique, engaging, and relevant.

You saw this one coming, right? It’s the necessary final step to any successful marketing strategy, especially in an industry that moves as fast as fintech.

As the finance and technology sector evolves, so should your marketing strategy. Regularly review your data (see Step 1) and see what is working and what isn’t. Hone in on what resonates with your audience and produces results. Fix what isn’t working or ditch it and reallocate the resources.

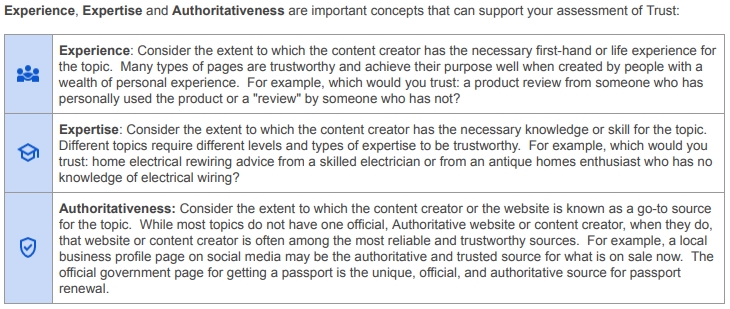

I’ve found that the devil is in the details with this stuff, too. For instance, with a fintech client, I noticed the author bios on their site did not contain information that we know Google appreciates according to E-E-A-T guidelines. I used the review process to optimize their bios and highlight their team’s credentials, linked their social bios to provide more social proof, and elaborated on their background in their bio. This simple action helped meet Google’s E-E-A-T standards and established the fintech brand’s content as coming from thought leaders who provided insightful, cutting-edge information.

If you want your fintech marketing to have an impact, perpetually revisit it and look for ways to optimize, update, and improve it.

If you’re going to invest in growth marketing, you want to do so with an eye toward industry ownership. With fintech, this requires a thoughtful strategy.

Start with your past data. Assess your strengths and study your current industry competition and landscape, too. Then, use your research to inform targeted content that you regularly review. An effective strategy is a great way to stand out in an industry with high customer acquisition and the need to develop a unique level of trust both before and after the point of purchase through targeted marketing efforts.

If your fintech startup or even an established company is struggling with its marketing, reach out for a free consultation. Our experienced team can help you assess your situation and develop a marketing strategy that can propel your company to prominence, even in an industry as crowded as the finance and technology sector.